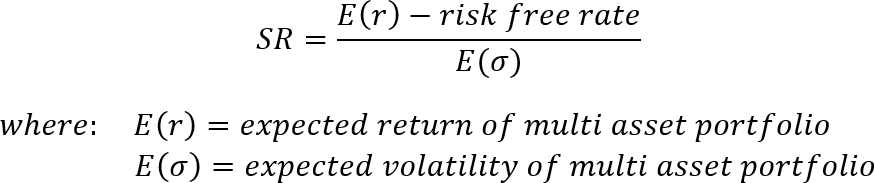

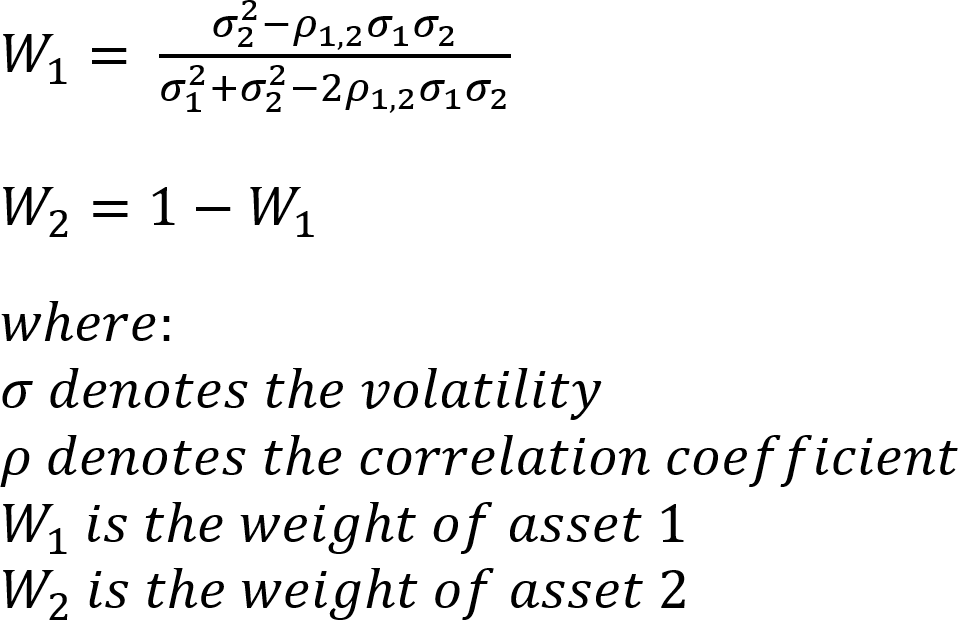

Portfolio diversification formula

The expected return of the portfolio is. VarR p w 2 1 VarR 1.

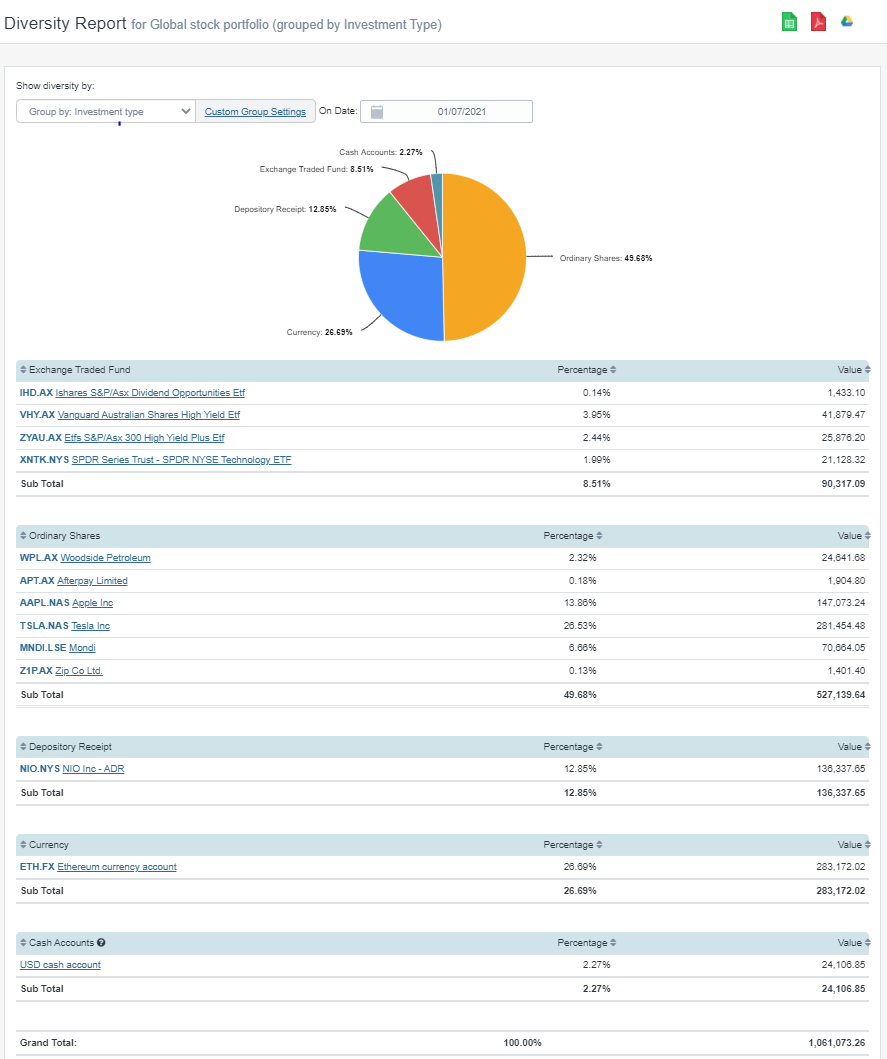

An Open Source Tool To Calculate The Overall Performance Of An Investment Portfolio Across All Accounts

It discusses the diversification ratio.

. The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N. A Fund With Unexpected Upside In Undervalued Companies Traded At Discounted Values. Square root of the sum of variance divided by number of.

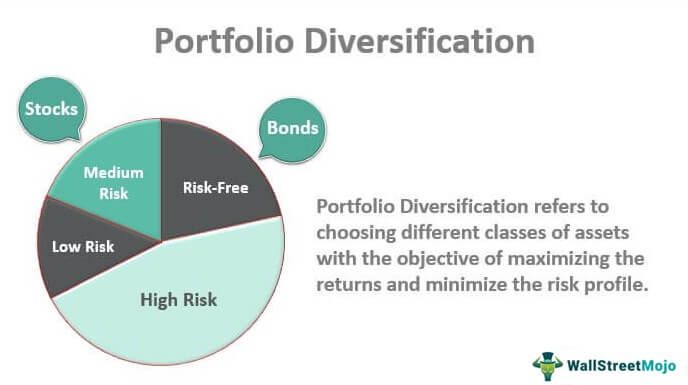

With a concentra- tion ratio of 50 the example portfolio has the. Explore the possibilities with Parametric. Diversification is a technique that minimizes portfolio risk by investing in assets with negative.

Ad See the Difference of a Personalized Approach. Portfolio diversification explains the two-way flow of capital between countries even when interest rates are equalized among countries. Expected Return 40005000 10 10005000 3 08 10 02 3 86 Standard Deviation Standard.

Customizable and flexible passive investing. Diversification can be achieved on many different levels. The volatility is calculated as.

Too few stocks and one blowup hurts the portfolio by a noticeable amount. It discusses the diversification ratio. Ad Solve unique client needs.

Eligible for Investments of 50k. This lecture is the Part 03 of series of lectures on Portfolio Management. Pretty simple right.

I have written many times. Diversification is a strategy that mixes a wide variety of investments within a portfolio in an attempt to reduce portfolio risk. The weight of one asset multiplied by its return plus the weight of the other asset multiplied by its return.

CFIs Math for Corporate Finance Course. Ad Help Your Clients Reach Their Goals W One Of Our Top Performing Funds. The formula for calculating an.

A Fund With Unexpected Upside In Undervalued Companies Traded At Discounted Values. The fundamental purpose of portfolio diversification is to minimize the risk on your investments. Too many stocks and you run the risk of a very expensive index fund.

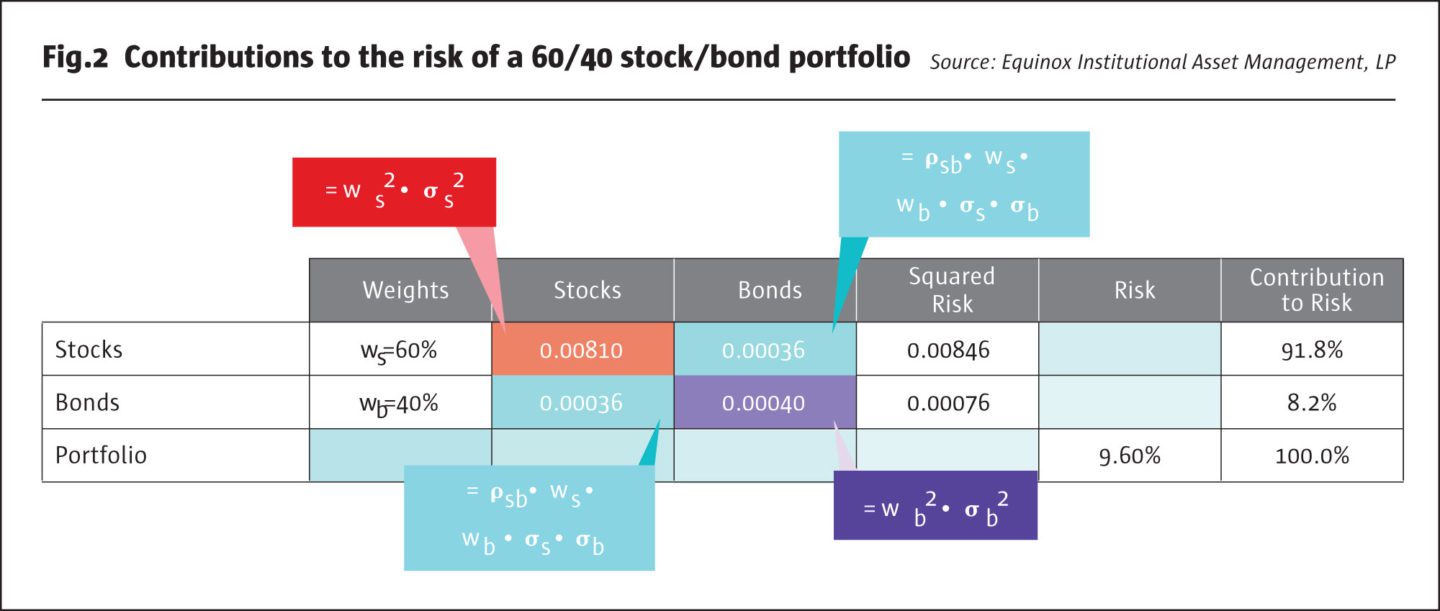

The correlation coefficient is calculated by taking the covariance of the two assets divided by the product of the standard deviation of both assets. The variability of returns on a portfolio is measured by. The formula for portfolio variance is given as.

The general rule of portfolio diversification is the selection of assets with a low or negative correlation between each other. Ad Help Your Clients Reach Their Goals W One Of Our Top Performing Funds. Purpose of portfolio diversification.

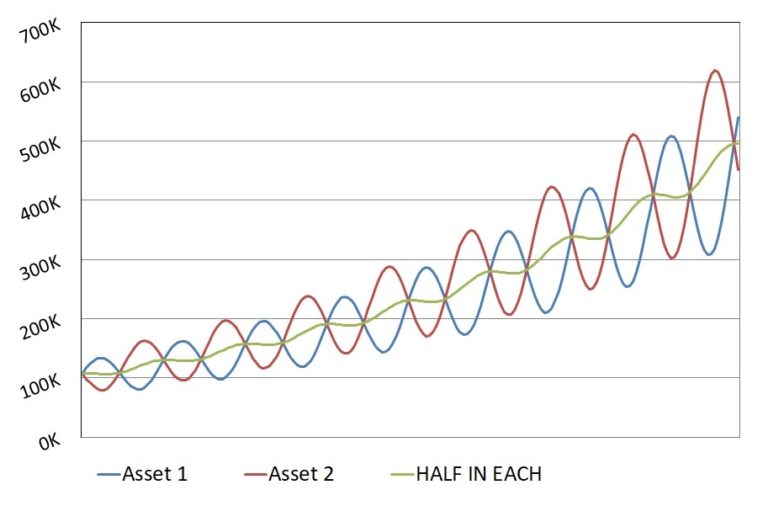

Parametric helps you strengthen your client relationships. Diversification can lower the variance of a portfolios return below what it would be if the entire portfolio were invested in the asset with the lowest variance of return even if the assets. Diversification is most often done by.

Securities sectors asset classes countries portfolio characteristics and even exposure to different types of risk factor to be. Where N is the number of monthly return values. If the constituents are equally weighted the portfolio standard deviation ie.

To calculate the SD for the SPY we use the following formula which is specific to calculating the SD for a single asset.

Reit Or Real Estate Investment Trust All You Need To Know Real Estate Investment Trust Real Estate Investing Investing

Minimum Variance Portfolio Simplified Meaning Examples All You Need

Portfolio Diversification How To Diversify Your Investment Portfolio

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Portfolio Diversification How To Diversify Your Investment Portfolio

Calculate Your Investment Portfolio Diversification With Sharesight

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

The Risk Contribution Of Stocks The Hedge Fund Journal

Proper Asset Allocation Of Stocks And Bonds By Age New Life Financial Samurai Stocks And Bonds How To Get Money Bond

Portfolio Diversification Correlation Risk Management Prudent Investors

Solactive Diversification The Power Of Bonds

Diversification Financial Edge

Proper Asset Allocation Of Stocks And Bonds By Age New Life Financial Samurai Stocks And Bonds How To Get Money Bond

Diversification Of Portfolios Matlab Simulink Example

Solactive Diversification The Power Of Bonds

/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)

What Is A Financial Portfolio